Written with Tim Murphy of New Dominion Consulting – June 2023

The Relationship Between Ocean Shippers and Carriers Needs a Reset

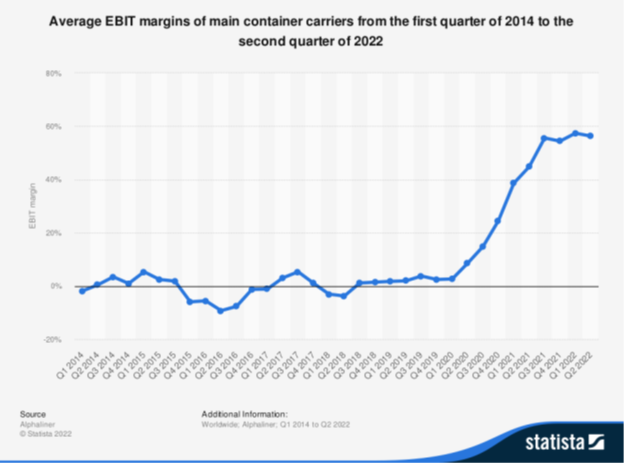

If FDR was correct, then ocean shipping managers and freight carriers must be very skillful sailors indeed. To say the relationship between ocean shippers and carriers is contentious would be an understatement. To understand the bad blood between these groups, one must look no further than the EBIT margins for container carriers over the past decade.

“Smooth seas do not make skillful sailors.”

– Franklin D. Roosevelt

Tough Times for Ocean Carriers

- From Q1 2014 through Q1 2020, the carriers had negative EBITDA in nine of twenty-five quarters.

- In the sixteen profitable quarters, only twice did the EBITDA margin exceed 5% while four of the nine negative EBITDA quarters were below -5%.

- The ocean carrier business requires the deployment of tremendous amounts of capital invested in ships and port infrastructure, earning a negative return on that capital instilled frustration in the carriers.

Profit Taking on the High Seas

- Starting in Q2 2020, the tables turned, and carriers gained leverage in price negotiations due to manufacturing and shipping complications caused by the COVID pandemic.

- Carrier EBITDA margins skyrocketed to levels not seen in the modern economy, peaking at 57% in Q2 of 2022.

- During the pandemic roles reversed, carriers took advantage of the leverage they had, and shippers are frustrated and angry.

The question before us is what route will be taken moving forward. The easy answer would be for the cycle to continue. Leverage is moving back to the shippers and spot rates are falling to levels last seen in early 2020. The stage is certainly set for a “shippers’ revenge” scenario to play out. Carriers are taking vessels off the water to reduce the supply of container capacity, prop up prices, and try to avoid the retribution they may have earned. However, it is hard to see how the continuation of this cycle will benefit either side in the long run.

A fascinating aspect of the ocean shipper and carrier relationship is that it is very different from supply chain relationships in other industries. It is hard to name another industry where suppliers’ strategic customers and companies’ strategic suppliers have such a negative, adversarial business relationship. Other industries face similar challenges to developing fair pricing models but have come up with much better ways to collaboratively address those challenges.

Pandemic Relationships in the Cold Light of Day

Many shippers are under the belief that their shipping provider (generally a NVOCC) did them “favors” by finding them space during the pandemic. The reality is that the shipping providers were managing space to optimize their profit, not their customers profits. Corporations were not receiving “favors” and should not be depending on “favors” to keep their operations running in the future. Corporations are engaged in commerce, not favor driven relationships, and need to proactively manage their logistics chains. Customers need to shift to a world where there are no “favors”, instead customers should be focused:

• Proactive solutions, not reactive fixes to shipping challenges

• Predictability in shipping slots, transit times, and container pricing

• Transparency on the location of shipping containers and their status

• Speaking the same language as the carriers, the key is to focus on return on capital

A Better Lane Forward

Continuing the cycle of pricing retribution is counterproductive. Carriers are not in a good position to reset relationships, but shippers currently are well positioned for a reset. Looking forward, shippers should focus on what they need instead of the concessions they can get. Most shippers’ greatest needs include stability, predictable shipping times, and forecastable costs.

Carriers also benefit from predictability, they need to fill ships to ensure positive return on capital, it is a goal where carriers’ and shippers’ objectives align. Carriers need cargo and revenue predictability so they can fill their ships and ensure a positive return on capital. Shippers need timeline and price predictability to maintain operational continuity, set reasonable prices for their customers, and maintain profit margins.

The alignment on desired predictability represents a significant opportunity to reset relationships. Focus on areas of mutual benefit where both parties gain from the give and take in the relationship. The opportunity exists in the current market for shippers to offer the olive branch to carriers, reset relationships, and collaboratively develop more constructive and mutually beneficial pricing models moving forward.

Recommendations

Last month ocean shippers and carriers contracted to set trans-pacific pricing for the next year. Now is the time to begin resetting the ocean freight industry so that next May the parties can have a more positive and mutually beneficial engagement. To reset the shipper/carrier relationship, companies need to:

1. Forego the opportunity to “get back” the higher costs they paid during the pandemic, take a long-term view of their ocean shipping needs, and develop strategic supplier relationships with the right ocean carriers.

2. Identify and engage with ocean carriers that fit the shippers’ business needs and are willing to invest in long-term, mutually beneficial supply chain relationships.

3. Formalize ocean carrier relationships, establish contracts with service level agreements and clear pricing.

4. Develop an approach to container pricing that is clear, fair, easily understood, protects against hidden fees, and works for both parties in both the short and long term.

5. Proactively manage ocean shipping provider relationships to identify opportunities for improvement and address any challenges encountered.